The U.S. stock market experienced significant turmoil on Thursday, exacerbating losses that had been accumulating since the onset of the trade war ignited by President Donald Trump’s tariff policies. The decline was particularly sharp across major indices, with the Dow Jones, S&P 500, and Nasdaq all seeing substantial drops. This article will delve into the reasons behind the tumble, its impact on the economy, and how it reflects the broader consequences of an ongoing global trade war.

The Context: Trade War and Its Escalation

- Background on the Trade War

The trade war between the U.S. and the European Union (EU) and China began under President Trump’s administration. The core of the conflict was the imposition of tariffs on billions of dollars worth of goods, aimed at correcting trade imbalances. Over the years, the tension between the U.S. and its trade partners has escalated, contributing to market instability. - Trump’s Latest Move: Tariffs on Alcohol

The most recent development involves the imposition of a 200% tariff on champagne and other alcohol products from the EU. President Trump’s announcement further fueled market fears and investor uncertainty, which quickly translated into a sharp decline in U.S. stocks. - The Global Economic Ripple Effect

Global markets are interconnected, and every policy change from a major economic power like the U.S. causes ripple effects worldwide. The continuous back-and-forth between the U.S. and its trade partners is a destabilizing force that has affected international trade, supply chains, and the stock markets.

U.S. Stock Market: Key Indicators and Performance

- The Dow Jones Industrial Average

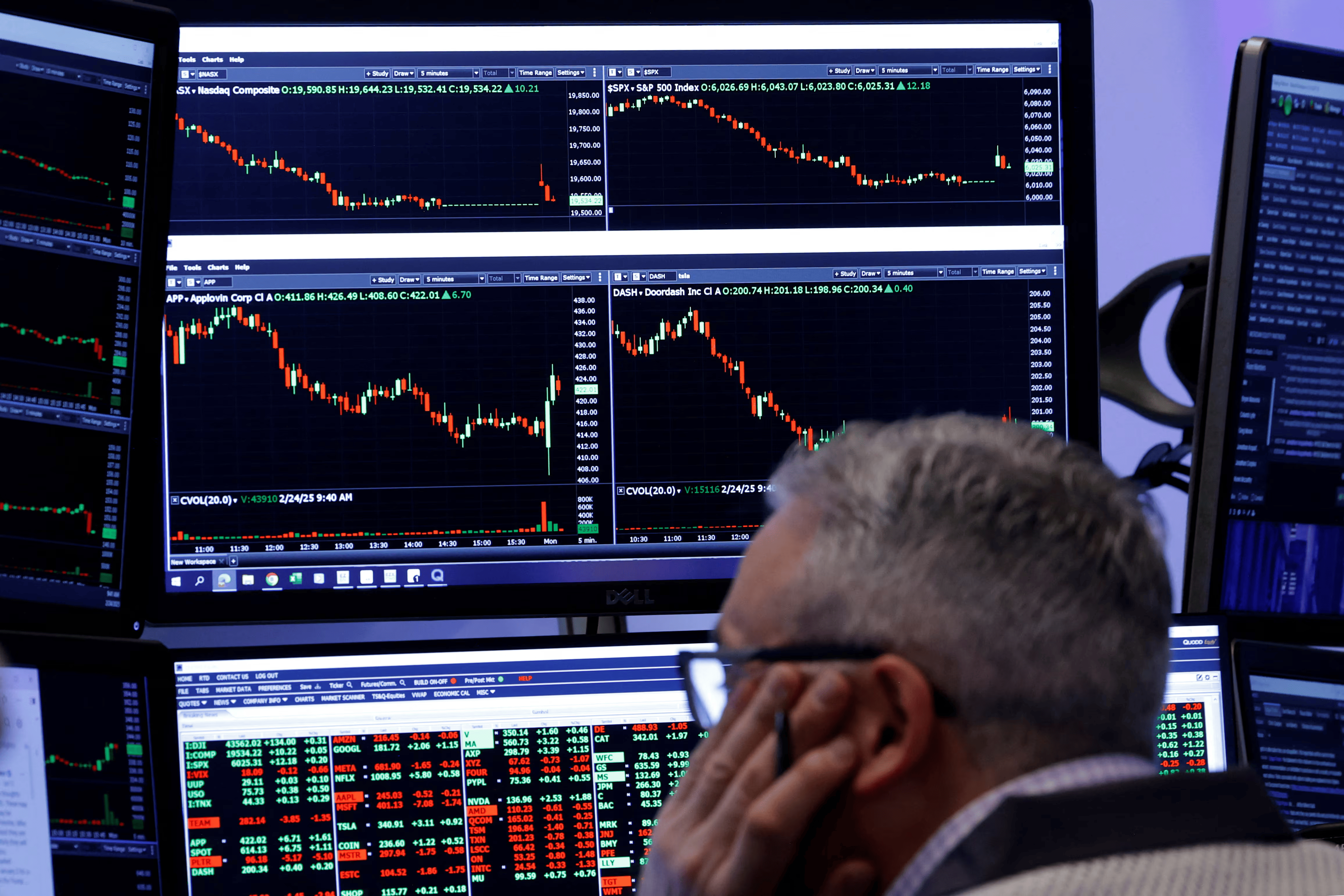

On Thursday, the Dow Jones fell 535 points (1.3%), continuing its downward trajectory that began with the trade tensions. The Dow is often seen as a barometer of the overall U.S. economy, and its decline reflects investor concerns over future growth prospects amid global trade conflicts. - The S&P 500’s Correction

The S&P 500 saw a 1.4% drop, and this downturn marked a significant milestone: the index officially entered a market correction, defined as a 10% decline from its most recent peak. This is the first correction for the S&P 500 since October 2023. - The Nasdaq’s Struggles

The Nasdaq, a tech-heavy index, faced an even steeper decline of nearly 2%. Technology stocks, especially those reliant on international trade, have been among the hardest hit by tariff policies. Investors were especially concerned about the future of companies like Tesla, Apple, and others in the tech sector.

The Impact of Trade War on Specific Companies

- Tesla’s Decline

One of the most notable companies affected by the latest trade developments was Tesla. Tesla’s stock dropped by about 5.5% on Thursday, erasing some of the gains made the day before when President Trump had announced plans to purchase Tesla vehicles at a White House event. Tesla’s stock has already fallen over 40% this year, reflecting a broader skepticism about the electric vehicle market’s future amidst rising trade tensions. - The Broader Impact on Tech Stocks

Other tech giants, including Apple, Microsoft, and Amazon, have been similarly affected by tariffs. As these companies depend on global supply chains, including sourcing parts and manufacturing overseas, rising tariffs disrupt their cost structures and margins. - Consumer Goods and Retail Sectors

The retail sector, including companies like Walmart, Home Depot, and Target, faces rising costs due to tariffs. These companies may eventually pass the additional cost to consumers, which could reduce consumer spending and slow down economic growth.

Macroeconomic Factors at Play

- Inflation and the Federal Reserve’s Response

Inflation figures have been closely watched, especially in light of the trade war. U.S. consumer prices rose by 2.8% in February compared to the same month the previous year. While inflation has remained manageable, higher prices for goods due to tariffs can potentially exacerbate inflationary pressures. The Federal Reserve’s actions regarding interest rates will be crucial in determining how the market responds moving forward. - The Threat of a Government Shutdown

Adding to the uncertainty, a potential government shutdown looms as the deadline for a new spending bill approaches. A shutdown would further strain an already fragile economy and worsen investor sentiment.

Global Implications of U.S. Trade Policies

- European Union’s Response

The European Union, particularly France and Germany, has expressed strong opposition to the U.S. tariffs. The EU has retaliated with its own set of tariffs, which has escalated the situation into a global trade war. These moves not only hurt bilateral trade between the U.S. and the EU but also threaten to disrupt broader international trade. - China-U.S. Trade Relations

In addition to the EU, tensions with China continue to dominate the trade war narrative. Despite some attempts at negotiation, the trade dispute between the U.S. and China has resulted in heavy tariffs on billions of dollars of goods, with negative repercussions for the global economy.

Investor Behavior and Market Sentiment

- Market Volatility

The heightened volatility in the U.S. stock market reflects growing investor uncertainty about the long-term implications of the trade war. Stocks are likely to continue fluctuating based on news about tariff changes, trade negotiations, and political developments. - Safe-Haven Investments

Amid market volatility, many investors have turned to traditional safe-haven assets like gold and U.S. Treasury bonds. These assets are considered relatively stable during periods of market instability.

Frequently Asked Questions

What triggered the recent U.S. stock market decline?

The most recent stock market decline was triggered by escalating trade tensions, particularly U.S. tariffs on European goods, which increased investor uncertainty.

What is a market correction?

A market correction is defined as a decline of 10% or more from the most recent peak in stock prices. It is a normal part of market cycles and can occur in response to factors like economic slowdowns or geopolitical events.

How has Tesla been affected by the trade war?

Tesla has seen its stock drop by over 40% this year, partly due to concerns over the impact of tariffs on the electric vehicle market. A recent drop of 5.5% in Tesla’s stock reflects investor unease about the company’s prospects amidst the ongoing trade conflict.

How do tariffs affect the U.S. economy?

Tariffs can increase the cost of imported goods, leading to higher prices for consumers. This can reduce consumer spending, slow down economic growth, and increase inflationary pressures.

What is the Federal Reserve’s role in responding to these market conditions?

The Federal Reserve can adjust interest rates to help manage inflation and stabilize the economy. In times of uncertainty, the Fed may lower rates to stimulate economic growth or raise rates to combat rising inflation.

How do global trade tensions affect other countries?

Global trade tensions disrupt international trade, affecting supply chains and increasing costs for businesses worldwide. Countries involved in trade conflicts, like the U.S., EU, and China, are the most directly impacted, but other nations can also experience indirect effects.

Conclusion:

The recent U.S. stock market tumble amid escalating trade war tensions is a reminder of the vulnerability of markets to political decisions and international conflicts. Investors face an uncertain future as tariffs continue to disrupt global trade and economic growth. However, market corrections are a natural part of economic cycles, and investors must remain resilient, cautious, and informed.

While the stock market decline may worsen in the short term, there is still potential for a rebound if the trade dispute is resolved and if inflation and economic growth are managed properly. The U.S. economy is far from stagnant, but navigating the current challenges requires vigilance and adaptability from both investors and policymakers alike.